The Power of Business Process Automation: Why Every Modern Company Needs It

|

Getting your Trinity Audio player ready...

|

Most SME founders, understandably so, think that the hardest part of their business is about finding clients. Not entirely. The hardest part is keeping the business engine running: follow-ups, reconciliations, approvals, reminders, documentation… the quiet chaos that eats into their day without them noticing. Here’s a valuable insight:

“It’s not lack of talent that slows a company down, it’s lack of scalable processes.”

If you’re an SME founder, you will agree with this: running a business feels like juggling five balls while someone keeps handing you a sixth. You’re managing customers, vendors, employees, compliance, accounting, and growth – all at once.

And that’s why every modern company needs Business Process Automation, to make the engine of your business run smoothly with the least intervention from you as a founder.

What Business Process Automation (BPA) Actually Means

Let’s cut the jargon. Business Process Automation simply means:

Using software to automate repetitive, rule-based tasks so your team can focus on work that requires judgment.

It’s not about robotics. It’s not about replacing your people. It’s like upgrading from a manual car to an automatic one – same driver, less effort.

Here are simple examples you may already be doing manually:

- Invoices that need to be sent every month

- Customer tickets that come through WhatsApp/emails

- Inventory that needs updating

- Follow-ups that get forgotten

- Reports that are the same every week, copied from the same Excel templates

BPA takes these “reaction-based” tasks and turns them into “auto-run” tasks.

Why BPA Matters for Today’s SMEs

If you’re an SME founder, you probably feel this right now:

- Customer expectations are increasing

- Hiring is getting more expensive

- Compliance work keeps growing

- Remote teams make coordination harder

- Competition moves faster than ever

A 25–50-person company today carries the workload of a 200-person company. But with business process automation, you give your team the power of a larger workforce, without hiring one.

Microsoft CEO Satya Nadella said it best: “Doing more with less is the new way to innovate.”

Today’s SMEs feel this pressure the most. Here are the most common problems I saw across Indian SMEs that BPA can address:

1. Delayed Invoicing → Cashflow Problems

A Bengaluru-based design agency manually created each invoice. During peak months, they invoiced clients 10–15 days late – squeezing cashflow. After automating invoice generation, they cut the delay to same-day billing.

2. Errors in Manual Data Entry

A retailer in Coimbatore discovered they were losing money due to repeated catalog entry errors.

A NASSCOM report also confirms SMEs lose up to 20–30% of revenue due to data inaccuracies.

3. Customer Requests Lost in WhatsApp/Email

Most SMEs depend on WhatsApp for client communication. A Mumbai-based interior design firm admitted: “We sometimes forgot 20–25% of follow-ups because there was no workflow.”

Automating ticket triage reduced request leakage to nearly zero.

4. No Standard Process

Teams do the same task in 5 different ways. Automation forces clarity – you document the steps once, and the software follows them exactly.

5. Over-dependence on 1–2 Key Employees

Every SME has “that one person” without whom nothing moves. Automation reduces risk by making processes independent of individuals.

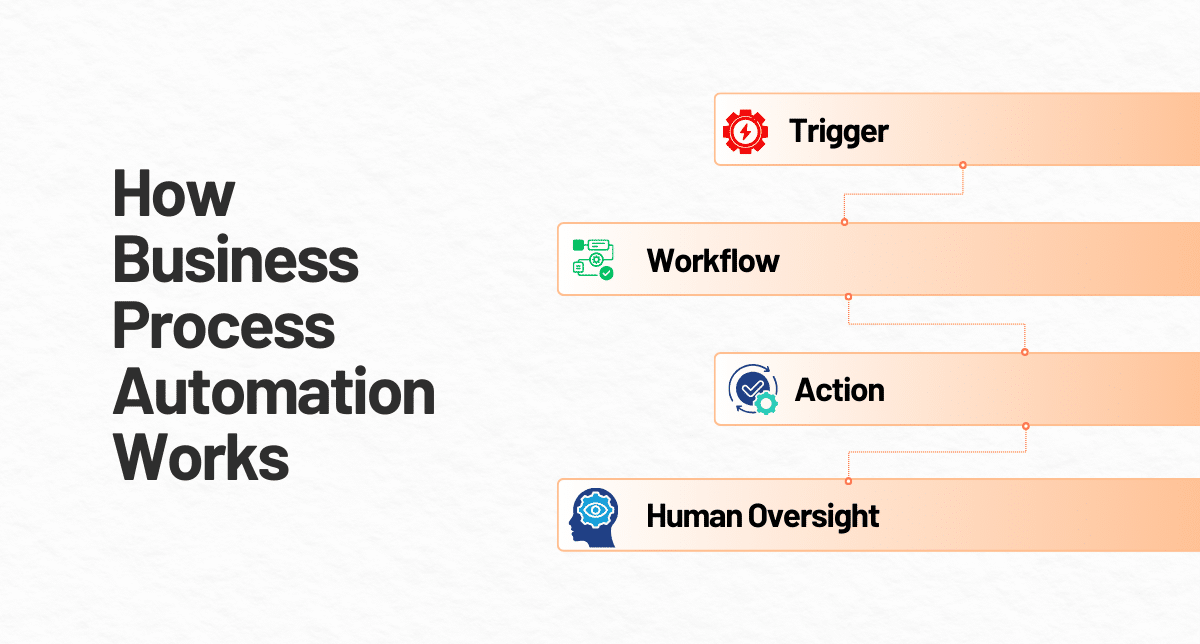

How Business Process Automation Actually Works

Let’s break BPA down into four simple parts:

1. Trigger: Something starts the workflow:

- A new invoice arrives

- A customer ticket is created

- A reminder date is reached

- A stock level drops

2. Workflow: The system decides what needs to happen next – automatically.

3. Action: The system sends the email, auto-updates the record, or requests approval – all without manual intervention.

4. Human Oversight: Humans step in only for exceptions or judgment-based decisions. This is exactly where Processvenue’s Human + AI model makes BPA safer and more effective.

Here’s How Business Process Automation Creates Real Value

1. Faster Operations:

A Jaipur-based D2C apparel startup automated order-status updates and reduced customer queries by 40%. This directly improved their NPS score and reduced workload on their small support team.

2. Fewer Errors & Better Compliance:

According to a KPMG India survey, human error is the #1 cause of compliance gaps for SMEs. BPA eliminates repeated mistakes – especially in GST, payroll, and documentation.

3. Improved Cashflow:

A Hyderabad logistics firm automated vendor payment reconciliation.

They clawed back ₹6 lakh worth of duplicate or delayed entries in the first quarter.

4. Predictable, Professional Customer Experience:

Indian customers today expect instant responses. Automated workflows make SMEs appear faster, more reliable, and more professional.

5. Founder Saves 10–20 Hours a Week:

This is a big one. Automation gives founders back the time to think, plan, and grow instead of firefighting.

How SMEs Can Start Small (Practical Blueprint)

Stop thinking automation means overhauling your entire business. Start with one small, high-impact workflow. Here’s a simple 30-day business process automation playbook:

Step 1 – Identify one repetitive process:

Examples: invoice creation, ticket triage, catalogue updates.

Step 2 – Map the process:

List the 5–6 steps your team already follows manually.

Step 3 – Identify what can be automated:

Look for repetitive, rule-based tasks.

Step 4 – Pilot automation:

Try a small workflow with Processvenue or a simple tool.

Step 5 – Scale based on results:

Once trust is built, extend automation to 2–3 more processes.

Automation doesn’t need a big bang – it needs one small win.

Processvenue’s View: Automation Designed for SME Reality

At Processvenue, we’ve seen the same pattern repeat across 100+ clients – when SMEs automate even one process, the impact compounds across the business. Our solution is simple:

✔ Backoffice Process Automation: Data entry, catalogue management, document verification – done with AI + human checks.

✔ Customer Support Workflows: Ticket triage, auto-routing, follow-up automation – reducing response times dramatically.

✔ Finance & Accounting Automation: Automated invoice processing, reconciliation, GST-ready reporting.

✔ Human + AI Model: AI handles repetitive work. Our team handles judgment, exceptions, and quality control.

This hybrid model works especially well for SMEs because it reduces cost while maintaining trust and accuracy.

Closing Thought

If there’s one learning every SME founder should take, it’s this: Automation won’t replace your people – it will release your people.

It lets your business work smarter, move faster, and scale without chaos. And every modern company – no matter how small – deserves that advantage.

FAQs

Is automation expensive for SMEs?

Not anymore. Cloud-based tools and workflow automation services make BPA affordable even for 10–20 member teams.

Will automation replace my staff?

No – it removes repetitive tasks so your team can focus on quality work, not grunt work.

Is my company too small for BPA?

If you repeat a task more than 10 times a week, you’re ready for automation.

How soon can I see ROI?

Most SMEs see improvements in 30–60 days – faster processing, fewer errors, better cashflow.

What about data security?

Processvenue operates with strict security practices, follows ISO-certified processes, and is actively strengthening SOC2 compliance.