What is Financial Planning and Analysis (FP&A)?

Financial Planning and Analysis (FP&A) is a critical function that helps businesses manage finances, forecast performance, and make strategic decisions. It involves budgeting, financial forecasting, performance monitoring, and risk management to improve financial stability and growth. Continue reading to know more!

Understanding the Role of FP&A

Financial Planning & Analysis (FP&A) helps businesses make informed financial decisions by providing insights into budgeting, forecasting, and performance evaluation. It plays a key role in shaping:

- Strategic Financial Planning: FP&A teams develop financial models to guide business decisions and ensure efficient resource allocation. This helps align financial goals with overall company objectives.

- Financial Planning and Forecasting – By analyzing past and current financial data, FP&A professionals predict future revenue, expenses, and cash flow. Accurate forecasting helps businesses prepare for growth and potential risks.

- Performance Monitoring and Analysis – FP&A teams track key financial metrics, compare actual performance against budgets, and identify areas for improvement. This allows businesses to adjust strategies and improve profitability.

- Risk Management in Financial Planning – Identifying financial risks and preparing for economic shifts ensures stability. FP&A professionals assess different scenarios and create contingency plans to manage uncertainties.

Key Functions of FP&A

Financial Planning & Analysis (Fis) is crucial in helping businesses manage their finances effectively. It involves analyzing financial data, tracking performance, and identifying risks to support strategic decision-making. Three key functions of the FP&A process are:

Budgeting and Resource Allocation

You align financial resources with business objectives, ensuring spending is controlled and aligned with priorities. A structured financial planning process helps prevent overspending and supports long-term stability.

Performance Monitoring and Analysis

Strong financial planning and forecasting rely on accurate performance monitoring and analysis, and regularly reviewing financial data allows you to track revenue, costs, and profitability. This identifies improving efficiency and making adjustments when necessary.

Risk Management and Scenario Planning

Effective risk management in financial planning helps businesses stay prepared for unexpected challenges. This includes analyzing market changes, economic uncertainties, and operational risks.

FP&A vs. Financial Analysis: Key Differences Financial Planning & Analysis (FP&A) and Financial Analysis focus on evaluating a company’s financial performance, but they serve different purposes. Here’s how:

| Aspect | FP&A (Financial Planning & Analysis) | Financial Analysis |

| Focus | Future-oriented, strategic planning | Past and present financial performance |

| Key Functions | Budgeting, forecasting, performance monitoring, scenario planning | Financial statement analysis, ratio analysis, investment evaluation |

| Decision-Making | Supports long-term business strategy | Assesses financial health for investment and operational decisions |

| Data Used | Forecasts, budgets, operational data | Historical financial reports, market trends |

| Output | Financial models, scenario plans, budgets | Valuation reports, financial ratios, investment analysis |

| Primary Users | Executives, finance teams, stakeholders | Investors, analysts, management |

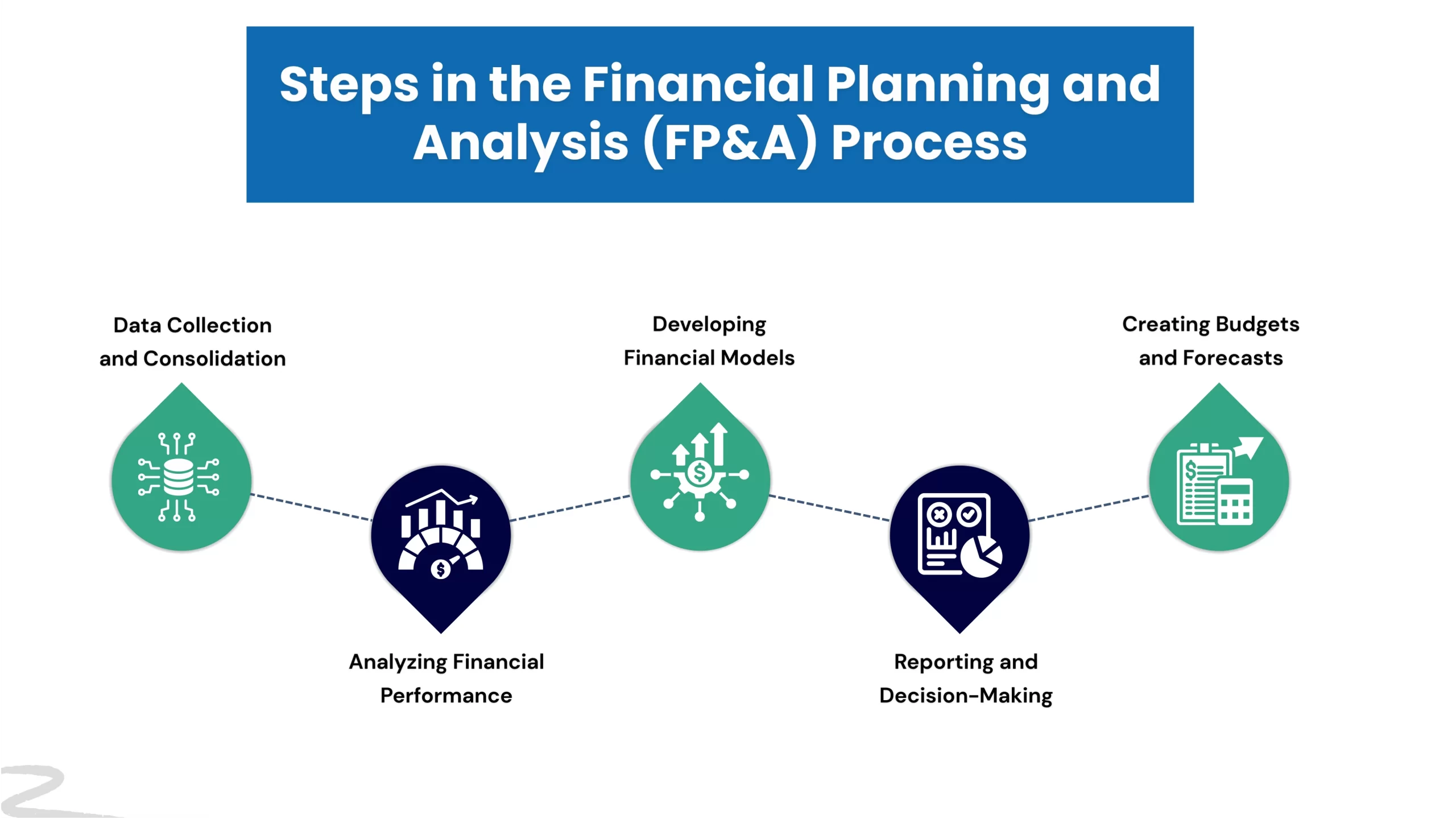

Steps in the FP&A Process

The Financial Planning & Analysis (FP&A) process helps businesses plan, monitor, and optimize their financial performance. It involves:

Data Collection and Consolidation

You gather financial and operational data from various sources, including accounting systems, sales reports, and market trends. This step ensures that decision-making is based on accurate and up-to-date information.

Developing Financial Models

You build financial models based on ancient business scenarios, project future performance, and assess potential risks. These models help you make informed strategic decisions.

Creating Budgets and Forecasts

You set budgets and develop forecasts based on historical data, market conditions, and business goals. This step helps in planning resources effectively and preparing for financial uncertainties.

Analysing Financial Performance

You track key financial metrics, compare actual results against budgets, and identify trends or discrepancies. This helps you evaluate business performance and adjust strategies as needed.

Reporting and Decision-Making

You present insights through reports and dashboards, helping executives and stakeholders make data-driven decisions. This step supports long-term financial planning and business growth.

Emerging Trends in FP&A

The Financial Planning & Analysis (FP&A) process is evolving with new technologies and business priorities such as:

Adoption of AI and Automation

AI and automation help streamline financial planning by reducing manual data entry, improving forecasting accuracy, and enabling real-time analysis. AI-powered tools can identify patterns in financial data, allowing for faster and more informed decision-making.

Advanced-Data Analytics in FP&A

FP&A teams are leveraging data analytics to gain deeper insights into business performance. Predictive analytics helps forecast revenue, optimize budgeting, and assess financial risks more accurately.

The Rise of Cloud-Based FP&A Solutions

Cloud-based FP&A tools allow businesses to collaborate across departments, access real-time financial data, and scale operations efficiently. These solutions eliminate the limitations of traditional spreadsheets and improve data security.

Integration of ESG Reporting

Environmental, Social, and Governance (ESG) reporting is becoming a key part of financial planning and analysis. Companies are incorporating ESG metrics into their financial models to assess long-term risks and align with investor and regulatory expectations.

How ProcessVenue Helps with FP&A Solutions

ProcessVenue provides financial planning and analysis (FP&A) solutions to help businesses maintain financial accuracy, improve decision-making, and drive growth. Our expert-driven services cover:

- Bookkeeping: Maintain accurate financial records for better financial management.

- Payroll Processing: Ensure timely and precise payroll execution.

- Accounts Payable/Receivable: Manage cash flow effectively with streamlined financial transactions.

- Tax Preparation: Simplify tax compliance and optimize tax planning.

Conclusion

FP&A ensures businesses allocate resources efficiently, anticipate financial challenges, and adapt to market changes. A strong FP&A process provides data-driven insights, helping organizations stay competitive and financially resilient.

FAQs

Why is FP&A important for businesses?

Financial Planning & Analysis (FP&A) helps businesses make informed decisions by analyzing financial data, monitoring performance, and identifying risks. A strong financial planning process ensures efficient resource allocation, improves profitability, and supports long-term growth.

What are the most common FP&A certifications?

Popular FP&A certifications include:

- Certified Corporate FP&A Professional (FPAC) – Focuses on financial planning and forecasting.

- Chartered Financial Analyst (CFA) – Covers investment management and risk management in financial planning.

- Certified Management Accountant (CMA) – Specializes in financial analysis and performance monitoring.

What are the biggest challenges in FP&A?

Common financial forecasting challenges include:

- Data accuracy: Inconsistent or outdated data can impact analysis.

- Economic uncertainty: Market fluctuations affect predictions.

- Technology integration: Adopting new FP&A tools requires training and adaptation.

How does budgeting fit into the FP&A process?

Budgeting is a key part of the FP&A process. It helps businesses allocate resources based on past performance and future goals. Budgeting supports financial planning and analysis by tracking expenses, identifying variances, and aligning financial strategies with business objectives.

What are some best practices for financial forecasting?

Some best practices for financial forecasting are:

- Use performance monitoring and analysis to track trends.

- Apply scenario planning to manage uncertainties.

- Leverage automation for accurate financial planning and forecasting.

- Align forecasts with business goals and market conditions.